You will use the cash receipts journal if your company uses the accrual accounting system. The other type of accounting system is cash based accounting where you just record cash coming in and cash coming out. This journal should be a sub-journal to your general ledger where non-cash receipts are kept.

Employment Accountant Tarrant County Col… – marketplace.dailyherald.com

Employment Accountant Tarrant County Col….

Posted: Thu, 03 Aug 2023 10:31:48 GMT [source]

These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy. Doing this will help to keep your customer’s accounts current and accurate.

What is the purpose of the cash receipts journal?

Cash receipts journals are key when monitoring cash flow and accounts receivable, which are two essential accounts when it comes to the success of any business. The cash receipts journal monitors cash flow and is essential to a successful business. This helps monitor and track the cash collected throughout a business’s cash transactions.

- These records can include transaction amount, account name, receivable ledger, receivable account, and more.

- The cash receipts journals can be printed at anytime for reconciliation or audit purposes.

- It is essentially the same as the other column on the debit side, with the exception that instead of an account name sub-column, it has a Ref. column for account numbers.

- In the debit column of a cash receipts journal, there will always be a cash column and, in most cases, a column for sales discounts.

- This journal is used particularly to record receipt of cash from all sources.

- Assuring that every cash transaction made is posted to the appropriate account is important as well in order to keep information organized within the journal.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed. Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images. One change that may improve the other accounts column for businesses with a number of accounts would be to switch out the account names sub-column with an account number column.

How to Record a Journal Entry for a Sale on an Account

The cash receipts journal is used to record all receipts of cash for any reason. Anytime money comes into the company, the cash receipts journal should be used. Making entries in a cash receipts journal is a pretty simple and straightforward process.

The concept is essentially invisible in many accounting software packages. Read on as we take a closer look at what a cash receipts journal is, the different types, and the pros and cons. Depending on a company’s requirements, different formats are used for a cash receipts journal. To help you understand the recording procedure, a simple format is given below. To log these transactions in a cash receipts journal, each of these transactions is entered sequentially into the journal in the appropriate column. At the end of the period, the TOTALS only would be recorded in posted directly into the accounts listed with no journal entry necessary.

In cash receipt remitties journals, cash receipt records are recorded in the CRJ. A cash payment journal consists of the records of every amount paid by a customer. As previously mentioned, cash receipt journals record the inflow of cash from any source. The Cash Receipts Journal prints a list of your customer receipts in

journal format. Use this report to verify General Ledger posting accounts

of receipt transactions.

Other sources of cash often include banks, interest received from investments, and sales of non-inventory assets. When a business gets a loan from a bank, the transaction to record the loan is made in the cash collections journal. A journal is where financial transactions are first recorded and are recorded chronologically with a brief explanation.

Format and posting of cash receipts journal

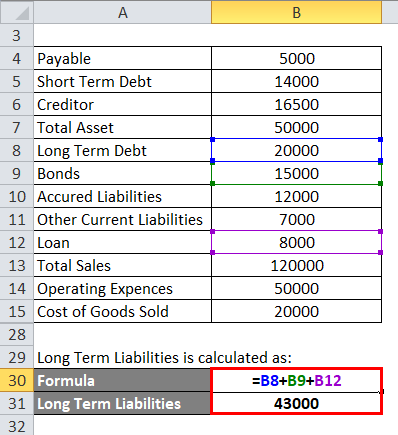

Other debit columns may be used if the firm routinely engages in a particular transaction. The following example illustrates how a cash receipts journal is written and how entries from there are posted to relevant subsidiary and general ledger accounts. A cash disbursements journal is the counterpart to the cash receipts journal. The cash disbursements journal itemizes all business expenses made with cash. Typical information included in the disbursement journal is the check number, the payee, disbursement amount, and the transaction type.

Cash receipt journals help to keep track of accounts receivable and aged receivables. Any transaction through the accounts recievable should also be listed to the accounts recievable ledger as well. Assuring that every cash transaction made is posted to the appropriate account is important as well in order to keep information organized within the journal. And, enter the cash transaction in your sales journal or accounts receivable ledger. All cash receipts for a given accounting period are recorded in the cash receipts journal, a special kind of accounting journal. Cash receipts, on the other hand, serve as documentation of a cash sale from the cash received for your company.

FINANCIAL SERVICES

If the deposit balance for any of the deposit dates

does not balance, the out-of-balance amount prints on the report. You

must correct your entries in Cash Receipts Entry before continuing with

the update. The receipts journal can be customized for your department by updating the information in the upper left column, rows 5-9. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Harold Averkamp (CPA, MBA) has worked as a university accounting instructor, accountant, and consultant for more than 25 years.

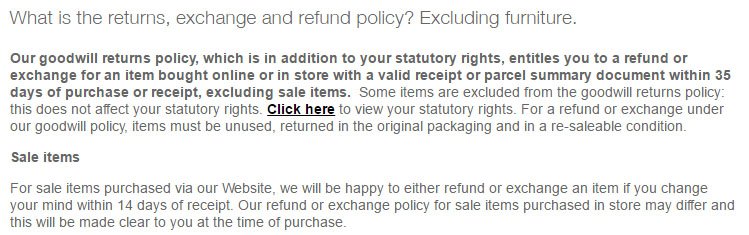

Any cash receipts journals that a unit submits for a credit card or depository account will automatically be rejected. Additionally, cash receipt journals can also help with cash payments that may be on an accrual basis while providing detailed lists of all the cash the company receives. Many businesses enjoy the benefits of a cash receipts journal as depending on the business, a large portion of their customers may prefer to use cash. This can be beneficial to avoid the headache that can sometimes come with making credit sales. A cash receipts journal is a special journal that records the receipt of cash by a business from any source during an accounting period.

Cash receipt journals are not for transactions such as credit sales and debit but are meant for cash payments only. For additional accounting such as debit and credit sales transactions, it is best to find other sources for management. The cash disbursement diary and the cash receipts journal are typically divided. In contrast to a cash account, which is an account within a general ledger, a cash receipts journal is a separate ledger.

Sand releases annual audit report on city of Clarinda – KMAland

Sand releases annual audit report on city of Clarinda.

Posted: Tue, 25 Jul 2023 15:36:00 GMT [source]

After this, every transaction in the sundries column needs to be posted to the appropriate account in the general ledger as a credit. Then we enter “Cash Sales” into the column for explanation and subsequently enter the amount of $409 into the cash debit and sales credit columns. This journal is used particularly to record receipt of cash from all sources. Keep in mind, the cash receipt process varies from business to business. You can tweak the above steps to better fit the workflow of your company. When customers pay with a mixture of payment methods, you need to account for it.

The last four digits of the customer’s

credit card or ACH payment account, the payment type, and the authorization number are included on

the report. To keep your books accurate, you need to have a cash receipts procedure in place. Your cash receipts process will help you organize your total cash receipts, avoid accounting errors, and ensure you record transactions correctly. Additionally, accessing monetary information through a cash receipts journal is far quicker than tracking the cash payment through a ledger. A cash receipts journal is also known as a specialised accounting journal. You can see how these journal entries (using the perpetual inventory method) would be recorded in the general ledger as by clicking fooz ball town to save space.

Depending on how frequently you get cash from customers, there can be a lot of entries in this journal. A check is placed under the total of this column as this total is net posted. He has written for Bureau of National Affairs, Inc and various websites. He received a CALI Award for The Actual Impact of MasterCard’s Initial Public Offering in 2008. McBride is an attorney with a Juris Doctor from Case Western Reserve University and a Master of Science in accounting from the University of Connecticut. Join over 1 million businesses scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.

If the deposit date is in a future

Job Cost period, the payment received information is updated to the future

period. You record cash receipts when your business receives cash from an external source, such as a customer, investor, or bank. And when you collect money from a customer, you need to record the transaction and reflect the sale on your balance sheet. When you collect money from a customer, the cash increases (debits) your balance sheet. Whenever a company receives cash for any reason, the journal entry is recorded in the cash receipts journal.

The cash receipts journals can be printed at anytime for reconciliation or audit purposes. If you plan on depositing cash payments, make sure your deposit slip amount matches your cash receipts journal. Store deposit receipts along with your other business receipts in case of any discrepancies.

This entry would then be posted to the accounts payable and merchandise inventory accounts both for $2,500. Under the periodic inventory method, the credit would be to Purchase Returns and Allowances. Cash receipts journal manages all cash inflows of a business organization. In other words, this journal is used to record all cash that comes into the business. For recording all cash outflows, another journal known as cash disbursements journal or cash payments journal is used. Any transactions that you have posted in the accounts receivable column will need to be posted every day to the subsidiary accounts receivable ledger.

As of July 26, 2021, the posting of cash and check deposits to the general ledger will be automated through cash management. The automated posting of these deposits will relieve units of the need to prepare cash receipt journals for cash and check deposits. This new process will limit potential errors and ensure that deposits are recorded in a timelier manner.